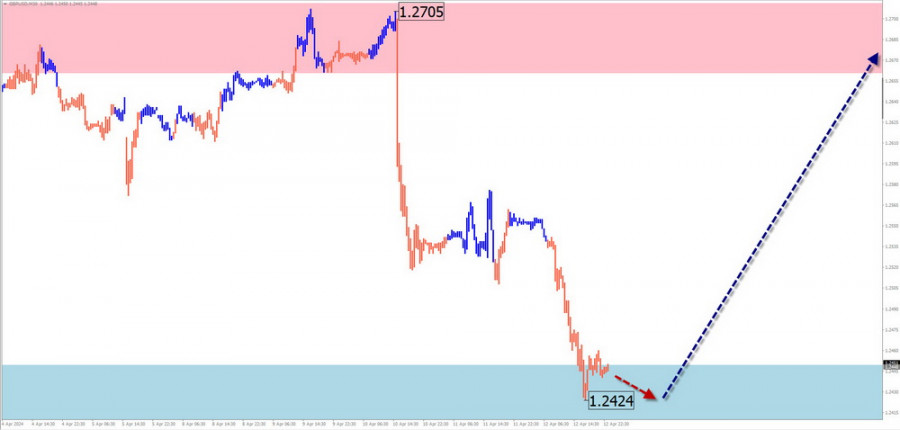

GBP/USD

Analysis:

On a large scale, a bearish trend has been forming in the price chart of the pound since July last year. In the wave structure, the entire month has seen the development of the final part (C). Quotes have reached the upper boundary of the potential reversal zone of the daily TF.

Forecast:

Pressure on the support zone is expected in the next couple of days. Then, a reversal and resumption of the upward direction can be anticipated. Upon changing the course, a brief breakthrough of the lower support boundary remains possible. The calculated resistance represents the upper limit of the expected weekly movement of the pair.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Selling: There will be no conditions for such transactions in the coming week.

Buying: They will become possible after the appearance of corresponding reversal signals in the support zone.

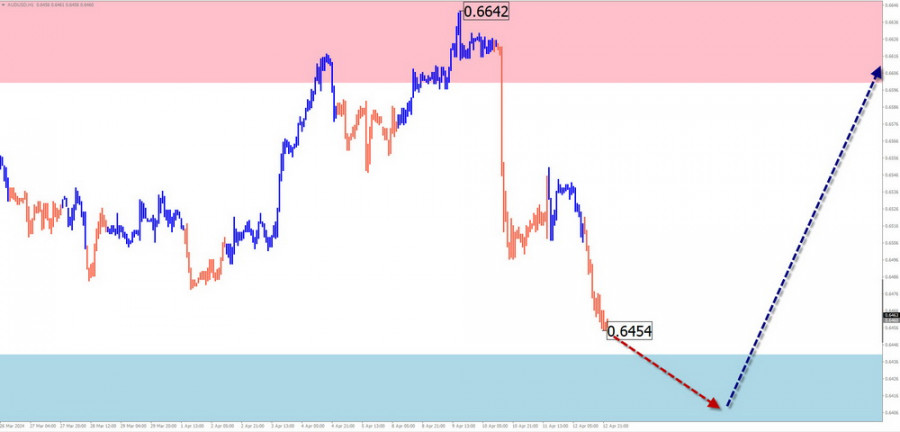

AUD/USD

Analysis:

A descending wave algorithm has defined the price fluctuations of the major Australian dollar pair since December last year. Since mid-February, quotes have been forming a counter-correction in a sideways trend. The corrective structure at the time of analysis needs to be completed.

Forecast:

In the upcoming week, a gradual movement of Australian quotes from the calculated support zone towards the resistance area is expected. Breaking through beyond the indicated boundaries during the upcoming week is unlikely.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Selling: Possible with a fractional volume within individual sessions.

Buying: These may be used in trading transactions after confirmed reversal signals appear in the calculated resistance zone.

USD/CHF

Analysis:

In the short term, the current wave of the Swiss franc from December last year is directed upwards. The wave completes a larger bullish construction of the weekly TF. The wave structure has entered the final phase. The lower boundary of a powerful potential reversal zone passes through the calculated resistance area.

Forecast:

The general upward course of the franc's price movement is expected in the upcoming weekly period. A short-term price rollback towards the support zone is included in the next couple of days. It is unlikely to break through its lower boundary. The highest activity is expected towards the end of the week.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Selling: Carry a high degree of risk and may be unprofitable.

Buying: This will become relevant for trading transactions after confirmed reversal signals appear in the support zone.

EUR/JPY

Analysis:

An ascending trend dominates the euro/Japanese yen pair chart on a large scale. The current corrective segment accounted for from March 20th still needs to be completed. The extremes of this wave on the chart formed a "flag" pattern. The price reached a strong support level at the end of the last week. The subsequent upward segment after the contact has reversal potential.

Forecast:

A flat mood of price fluctuations can be expected in the next few days. A downward vector is possible, with a price decrease no further than the calculated support boundaries. In the second half of the week, the probability of increased volatility, reversal, and resumption of active price growth increases.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Selling: There are no conditions for such transactions in the pair market.

Buying: After the appearance of corresponding signals in the support zone, they may become the main direction for trading transactions.

AUD/JPY

Analysis:

The unfinished wave structure of the dominant ascending trend of the Australian dollar/Japanese yen pair since last June is accounted for. The wave is a shifting wave plane, occupying a corrective position. Quotes are at the lower edge of a powerful potential reversal zone of the weekly TF chart.

Forecast:

At the beginning of the upcoming week, there is a high probability of a flat movement mood along the resistance zone. Subsequently, a decrease in quotes can be expected down to the calculated support boundary.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Buying: Possible within individual trading sessions with a reduced volume. The potential is limited by resistance.

Selling: Premature until confirmed reversal signals appear in the resistance zone.

US Dollar Index

Brief Analysis:

An ascending wave algorithm determines the direction of movement of the North American dollar index since December last year. The wave structure of the zigzag forms the final part (C). The calculated resistance zone is located at the lower boundary of a powerful potential reversal zone of the weekly TF.

Weekly Forecast:

The rise in the US dollar exchange rate can be expected in the next couple of days. A transition to a sideways drift with a high probability is expected further in the calculated resistance area. A decrease in index quotes can be expected towards the end of the week.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

The period of weakening the dollar and buying national currencies in major pairs is temporary. Sales of national currencies in major pairs may become the main direction for trading after the appearance of corresponding reversal signals in the support zone.

Explanation: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed at each TF. Dotted lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of movements of instruments over time!