The GBP/USD currency pair did not come close to the moving average line on Tuesday. Although a new corrective movement appeared to begin on Monday, it quickly lost momentum. Throughout both Monday and Tuesday, the market had no reason to abandon selling the pair. A wide range of technical, macroeconomic, and fundamental factors continue to support ongoing selling, while buying signals are mostly indicated only by divergences and oversold readings from the CCI indicator. At this point, there are no compelling reasons to believe that the downtrend will end.

However, today's market sentiment regarding the dollar and the pound could shift slightly due to the scheduled release of inflation reports for both the UK and the US. The outcomes of these reports may surprise the markets. While it is unlikely that these reports will lead to a complete change in trading strategies, they could affect short-term market behavior. Additionally, in just one week, Donald Trump will officially take office as President of the United States.

We will avoid speculating on the potential outcomes of the upcoming inflation reports, as such predictions often prove to be futile. Instead, it is crucial to stay vigilant and closely monitor market dynamics today. Any conclusions about the future trajectory of the currency pair can be drawn later in the evening or on Wednesday. However, we expect that a higher-than-expected US inflation reading could cause the GBP/USD to decline significantly, overshadowing all other factors. Elevated US inflation would suggest that even the two projected interest rate cuts by the Federal Reserve in 2025 might not happen. As a result, the outlook for the dollar would become even more hawkish.

The British pound has been entrenched in a 16-year downtrend and has been unable to benefit from corrections. It is unlikely to experience a significant rally, even if UK inflation exceeds expectations. In such a scenario, one must consider how this would help the pound. The Bank of England is already hesitant to cut its key interest rate but is likely to do so in the future, given the ongoing stagnation of the UK economy. A weak economy is a reason to sell the pound, not buy it, regardless of inflation levels under an unchanged BoE policy.

As we approach the inflation reports, it's evident that the British pound would require an extraordinary combination of favorable conditions to create even a short-term upward trend. The daily and weekly timeframes show that the situation has not changed, indicating there is still significant potential for further declines in the value of the British currency.

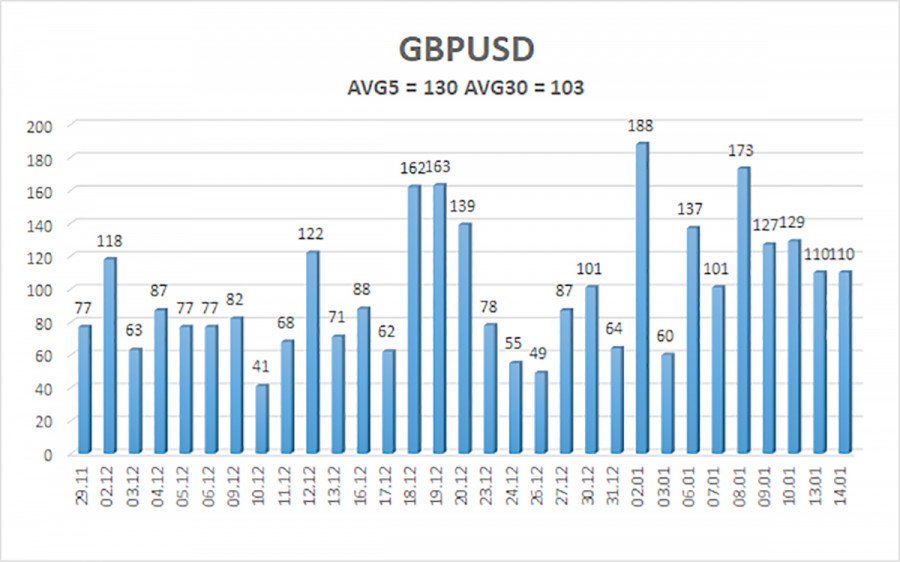

The average volatility of the GBP/USD pair over the last five trading days is 130 pips, which is considered high for this pair. On Wednesday, January 15, we expect the pair to move within the range of 1.2052 to 1.2312. The higher linear regression channel is trending downward, indicating a bearish outlook. Although the CCI indicator has entered the oversold zone again, a downtrend usually means that any oversold signal will likely only result in a correction. A previous bullish divergence in the CCI also signaled a correction, which has already occurred.

Closest Support Levels:

- S1 – 1.2207

- S2 – 1.2085

- S3 – 1.1963

Closest Resistance Levels:

- R1 – 1.2329

- R2 – 1.2451

- R3 – 1.2512

Trading Recommendations:

The GBP/USD pair continues to exhibit a bearish trend. Taking long positions is not advisable at this time, as we believe that all potential factors supporting the British currency have already been priced into the market, and no new bullish factors are currently available. Based purely on technical analysis, long positions could be considered if the price consolidates above the moving average line, with targets set at 1.2390 and 1.2451. However, sell orders remain the more relevant strategy, with targets at 1.2085 and 1.2052.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.