The GBP/USD currency pair experienced a decline on Monday, which was expected. Over the past five trading days, the British pound has lost 450 pips, and in the last three months, it has dropped by 1,300 pips. We still believe that this is not the bottom for the pound. When we look at the weekly timeframe, it becomes evident why we anticipate this scenario. The last segment of the 16-year downtrend ended around 1.0350. At that time, many believed this marked the worst for the pound and that it couldn't fall any further. However, a new phase of the global trend may have commenced three months ago. If this is true, the decline should continue, at least until parity.

On the daily timeframe, the situation for the British currency is similarly bleak. A three-month collapse persists, with no signs of correction, as the pound continues to fall even on days devoid of local reasons. Yet, the global fundamentals and market dynamics remain firmly in place. Let's clarify what we mean by that. The global fundamental backdrop includes the monetary policies of the Federal Reserve and the Bank of England, as well as the economic conditions in the U.S. and the UK. Regarding the latter, there are unlikely to be any questions: the U.S. economy is clearly stronger and is growing at a much faster pace. In fact, any economy growing at rates "greater than zero" is outpacing the UK, which is experiencing near-stagnation.

The Fed's monetary policy is expected to be more hawkish than previously anticipated, while the Bank of England is likely to adopt a dovish stance in an effort to stimulate the economy. However, the most notable aspect is that since September 2022, the market has sold off the dollar, prematurely pricing in Fed easing while largely ignoring potential moves by the Bank of England. It is now evident that the Fed plans to implement only two rate cuts in 2025, and even those are not guaranteed. This suggests that most global factors are supportive of the dollar. Additionally, Donald Trump's potential return to the presidency could further strengthen the dollar. The market has miscalculated, incorrectly anticipating dovish actions from the Fed.

Currently, the market needs to "rebalance" the exchange rate to reflect its fair value, considering Trump's inflationary policies and the Bank of England's plans for easing. The persistent 16-year downtrend indicates that we are just at the beginning of the next leg. We believe the British pound will continue to decline over an extended period. Of course, if the underlying conditions change, we will adjust our forecasts accordingly. Within the prevailing trend, there will likely be corrections—possibly even significant ones. However, our overall outlook remains unchanged: we see no reason for the pound to appreciate. The only question is when the market will start to partially lock in profits on short positions.

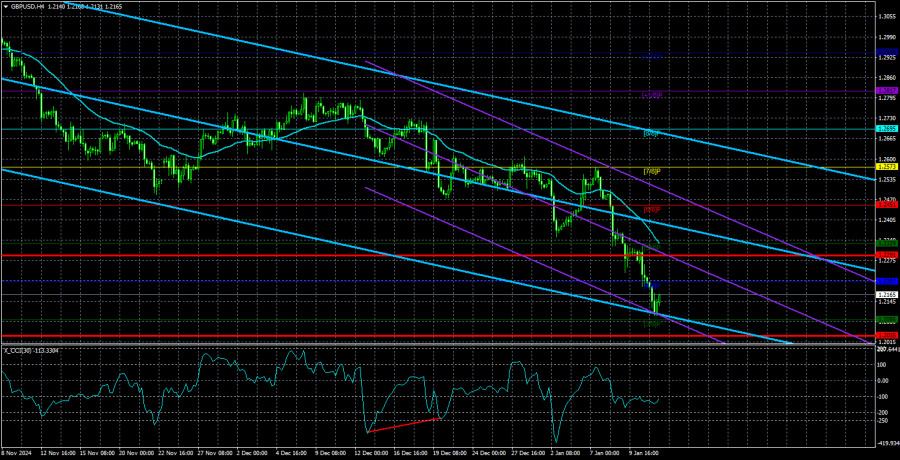

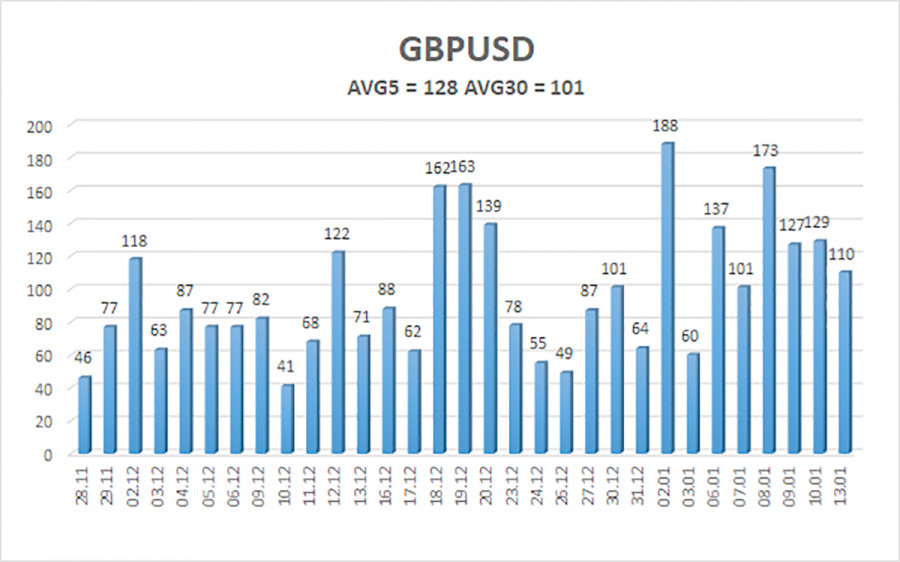

The average volatility of the GBP/USD pair over the last five trading days is 128 pips, which is considered high for this pair. On Tuesday, January 14, we expect the pair to trade within a range of 1.2035 to 1.2291. The higher linear regression channel is oriented downward, indicating a continuing downtrend. The CCI indicator has once again entered the oversold zone; however, oversold conditions during a downtrend typically signal only a potential correction. A bullish divergence in the indicator suggested a correction, which has now been completed.

Nearest Support Levels

- S1: 1.2085

- S2: 1.1963

- S3: 1.1841

Nearest Resistance Levels

- R1: 1.2207

- R2: 1.2329

- R3: 1.2451

Trading Recommendations:

The GBP/USD pair remains in a downtrend. Long positions are not currently recommended, as we believe that all factors supporting the British currency have already been factored into the market several times, and there are no new driving forces present. For traders focusing solely on technical analysis, long positions might be considered if the price rises above the moving average, with target levels at 1.2451 and 1.2573. However, short positions are still far more relevant, with target levels at 1.2035 and 1.1963.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.